Charitable Gift Annuities

Support lifesaving research while receiving income for life

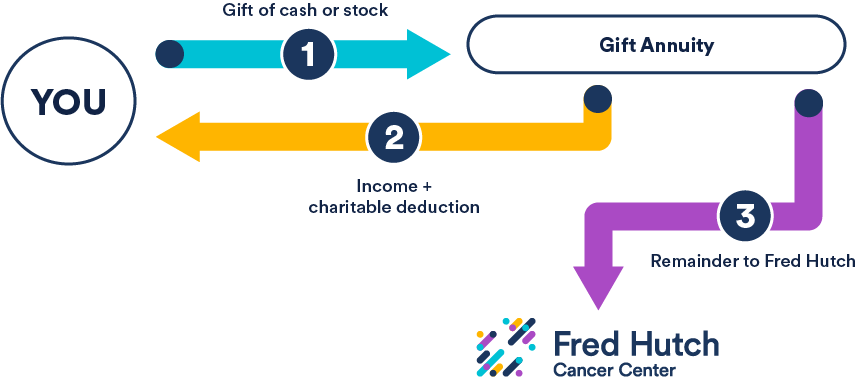

A gift that gives back

By establishing a charitable gift annuity with Fred Hutch, you can help secure your financial future while supporting research to cure cancer and other diseases faster. Once you complete your gift, you will receive fixed annual income for life, a portion of which will be tax free.

Here’s how it works: Say that Justin, 66, and Mary, 65, want to make a legacy gift but also want to ensure they have income for their retirement. They establish a $25,000 charitable gift annuity with Fred Hutch. Based on their ages, they will receive a payment rate of 3.9 percent, which means they will receive $1,050 each year for life. They are also eligible for a federal income tax deduction in the year of their gift of $5,957.* After their joint lifetime, Fred Hutch will use the remaining funds to support our lifesaving work.

*Based on annual payments and a 2 percent charitable midterm federal rate. Deductions vary based on amount given. If you are a NY State resident contact us for specific rates.

- You can receive fixed payments for as long as you live at a very attractive rate

- You may get a tax deduction now

- You might also have additional tax benefits depending on how you fund the gift annuity

- Your annuity could provide financial support for a loved one

- Your gift today will enable you to make a lasting impact on generations to come

“[A CGA is] good in the sense . . . that you have an income stream that will come back to you. But the most important thing, really, is the money goes to a good cause.”

— Stan Opdyke, Fred Hutch CGA Donor