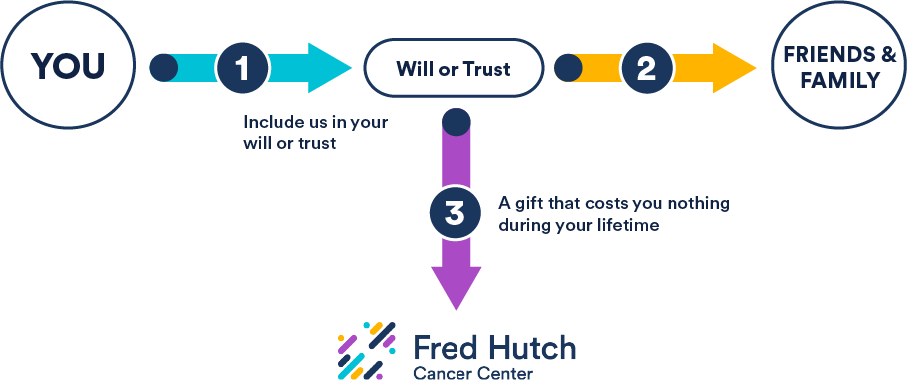

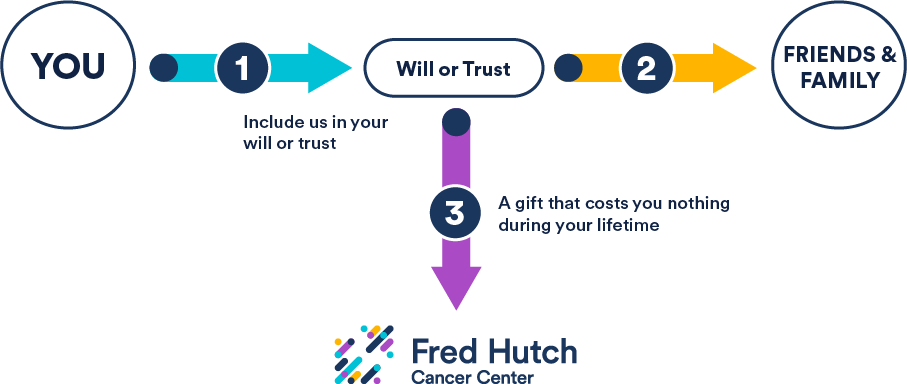

Gifts that Cost You Nothing Now

By simply signing your name, you can create a legacy that powers breakthrough research at Fred Hutch, helping us prevent and eliminate cancer and infectious disease. With a gift in your will or trust, or by naming us as a beneficiary on one of your financial or investment accounts, you inspire the internationally renowned researchers at Fred Hutch to work with even greater passion and urgency.

Once you have provided for your loved ones, we hope you will consider making scientific achievement and success part of your life story through a legacy gift.

Gifts that Cost You Nothing Now

Gifts by Will

Making a legacy gift in your will or trust is one of the easiest and most popular ways to drive new research breakthroughs at Fred Hutch.

Here are the ways that most people like to make this lasting gift:

- General bequest: Fred Hutch receives a specific amount of money, e.g., $10,000.

- Specific bequest: Fred Hutch receives a specific piece of property, e.g., art, jewelry, shares of a particular stock or the cash in a bank account.

- Residual bequest: Fred Hutch receives all or a percentage of the remainder of your estate after general and specific bequests have been fulfilled.

- “Greater of” residuary bequest: Fred Hutch receives the greater of either a percentage of your estate or a specific dollar amount.

- Contingent bequest: Fred Hutch receives a gift stated for other beneficiaries of your estate in the event of their prior passing.

- Trust remainder: Fred Hutch receives all or a portion of the remaining principal left from a trust after the death of the surviving beneficiaries or after a specified term.

Gifts by Beneficiary Designation

With a gift from your retirement plan, insurance plan or other assets, you support the groundbreaking discoveries and world-class scientists and clinicians Fred Hutch is known for, and your gift has an impact that lasts for years to come.

What’s more, giving a significant gift like this is as simple as contacting the firm that holds your assets and asking them for a beneficiary form to fill out.

Retirement funds gift

Many people choose to name Fred Hutch as a beneficiary of an IRA or other retirement fund to reduce taxes while advancing lifesaving research. This can be one of the most tax-wise ways to make a legacy gift.

Benefits:

- 100% of your gift will go toward our research and clinical programs. Since Fred Hutch is tax-exempt, we do not pay taxes on this gift.

- Avoid potential estate tax on retirement assets.

- Avoid income tax for your heirs on retirement assets funded on a pre-tax basis.

To name Fred Hutch as a beneficiary of your retirement plan, contact your bank and ask for a change of beneficiary form. For more information on changing your beneficiary, click here.

Gift of a life insurance policy

You may have a life insurance policy that has served its purpose and is no longer needed. If so, you can use it to fund a legacy gift for Fred Hutch, furthering our work to prevent and eliminate cancer and infectious disease. You can transfer ownership of the policy to Fred Hutch or name us as a beneficiary.

Transfer ownership: Giving a life insurance policy to Fred Hutch during your lifetime can help our mission in one of two ways. We can cash it in (assuming there is a build-up in value) and use the proceeds immediately towards our mission. Alternatively, it may make more sense to retain the policy until it matures. In that case, we would use the death proceeds to support our mission in the future. Either way, you are helping to advance the work of the internationally renowned scientists and clinicians at Fred Hutch.

Because it is an irrevocable gift, you may receive an immediate tax deduction when you transfer the policy to Fred Hutch. For any continuing premium payments you make, you will receive a charitable deduction in the year of the payment.

Name us as a beneficiary: You can name Fred Hutch as a beneficiary of all or a portion of your life insurance policy. With this gift arrangement, Fred Hutch will receive the proceeds of your policy upon your passing. You can change your beneficiary at any time. However, this flexibility means you will not receive an income tax deduction. Instead, your estate will receive a charitable deduction, which may reduce your estate taxes.

Another option, perhaps when your family is young, is for you to name Fred Hutch as the contingent beneficiary. This allows you to ensure that you have provided for your loved ones should you predecease them, while also potentially leaving a legacy gift to Fred Hutch.

The gift is easy to arrange — you complete and sign a beneficiary designation form.

Savings bonds

When you redeem savings bonds, you will owe income tax on the appreciation. So will the person who inherits them. You can eliminate the income tax on bonds you plan to redeem by donating them to Fred Hutch. Because Fred Hutch is tax-exempt, 100% of your gift of savings bonds will support our shared mission to drive scientific breakthroughs that lead to healthier lives.

Benefits:

- Reduce your income tax with a current gift.

- Reduce income tax and possibly estate taxes for your loved ones.

- Create your lasting legacy with Fred Hutch.

CDs, bank accounts, brokerage accounts and commercial annuities

One of the easiest ways to leave a legacy gift to Fred Hutch is to name us as a beneficiary of a certificate of deposit, a checking or savings account, a brokerage account, or a commercial annuity.

For more information on changing your beneficiary, click here.

Donor-advised fund (DAF) residuals

The contract you completed when you created your donor-advised fund governs the final distribution of the contributions you made during your lifetime. We hope you will consider naming Fred Hutch as one of the final grantees of your fund.

To turn your passion for curing cancer into a lasting legacy, contact us at 206.667.3396 or at plannedgiving@fredhutch.org for more information about legacy giving.

We are here to help

General Questions

Planned Giving

Phone: 206.667.3396

Email: plannedgiving@fredhutch.org

Asa Tate

Executive Director, Planned Giving

Phone: 206.667.4486

Email: atate2@fredhutch.org

Kevin Boyce

Director, Planned Giving

Phone: 206.667.7133

Email: kboyce@fredhutch.org

Stephanie Henderson

Senior Director, Planned Giving

Phone: 206.667.4974

Email: shenders@fredhutch.org

Renee Baars

Assistant Director, Planned Giving

Phone: 206.667.2206

Email: rbaars@fredhutch.org

Emily Eysaman

Philanthropic Gifts Coordinator, Planned Giving

Email: edavies@fredhutch.org